Group Term Life Insurance Cincinnati, OH

Group term life insurance is life insurance owned by a business, association, or other qualifying organization, for the purpose of providing life insurance benefits to its employees or members.

Group term life insurance is affordable, easy to secure, and delivers significant benefits.

To learn more about group term life insurance quotes and plan options in Cincinnati, Ohio – click here!

As a bonus, we’ll send you our FREE guide: 14 Ways to Improve Company Benefits and Save Money!

How does group term life insurance work?

Group term insurance is usually provided in the form of a fixed or structured benefit.

The total benefit amount per employee can vary based on the plan’s structure and any optional offerings.

Examples of benefit structures for group term life insurance:

An employer may choose to offer a simple “flat amount” of group life insurance coverage to all full time employees – such as $25,000 or $50,000 per employee.

Alternatively, an employer may utilize a “multiple of salary” formula to determine benefit amounts – such as 1x or 2x an employee’s salary.

An employer may offer a “mix” of flat coverage with the option for employees to purchase additional life insurance coverage at their own expense.

How is group term life insurance paid for?

Depending on how the plan is structured, an employer may elect to pay all or only a portion of group life insurance plan premiums.

For many plans, employers may be required to contribute a minimum percentage of premiums.

In other arrangements, the cost of premiums will be divided between the employee and the employer.

When an employee does elect to purchase additional or supplemental coverage, it is generally paid for via payroll deduction.

Is group term life insurance medically underwritten?

Underwriting for group term life insurance is different than for individual life insurance.

Depending on the size of your group, employer contribution amount, and participation level, there may be no requirement that you provide medical evidence of insurability to qualify for coverage.

Who is the beneficiary of a group life insurance policy?

In general, proceeds of a group life insurance policy will be paid to the beneficiary(s) designated by the participating employee.

For most employees this usually means an individual – such as a family member or spouse.

Are group term life insurance premiums taxable?

As of this writing (2018), the IRS provides for an exclusion for the first $50,000 of group term life insurance carried by an employer on an employee.

If an employee’s total group term life coverage exceeds $50,000, the “value” of that coverage must be calculated and included as taxable income less any employee contributions.

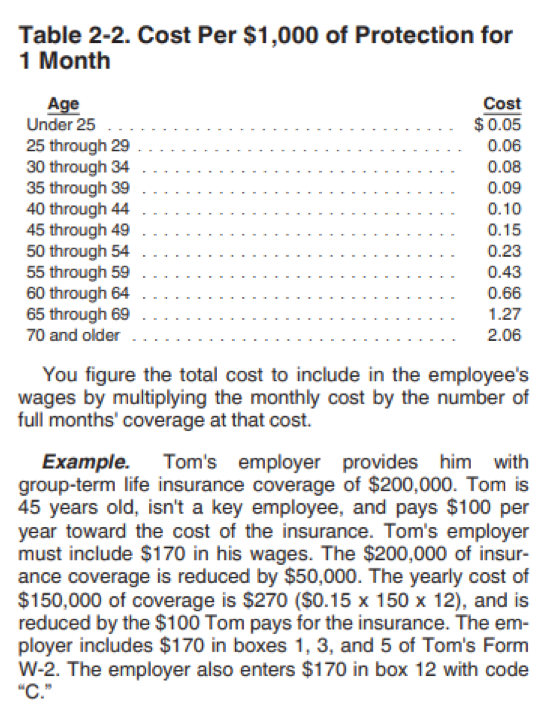

The IRS determines the value of coverage using a monthly factor as shown in the “IRS Premium Table.”

Below is a chart from IRS Publication 15-B from 2018 with an example of how the taxable value of excess group term life is calculated.

See: https://www.irs.gov/pub/irs-pdf/p15b.pdf

Learn more about the taxability of group term life insurance from the IRS at this link: https://www.irs.gov/government-entities/federal-state-local-governments/group-term-life-insurance

Do beneficiaries pay tax on the proceeds of group term life insurance?

In general, death benefits paid from group life insurance are typically paid tax free to beneficiaries.

Can spouses and dependents be covered by group term life insurance?

Yes. Many insurers offer additional options for dependent coverage. In general, however, these options are available in only limited coverage amounts.

How much group term life insurance does a person need?

The best answer is…it depends.

Life insurance can provide protection for a wide array of needs.

Some may use life insurance protection to cover the cost of an income for a their family, pay off personal debts (i.e. credit cards, student loans, car loans, mortgages, etc.), fund future obligations (such as education, retirement for a spouse), and more.

Group term life insurance is only one part of a person’s overall life insurance planning.

For most people, a mix of individually owned and employer-sponsored group term life insurance will help build the foundation of a complete life insurance plan.

Are there downsides to group term life insurance?

While group life insurance is an attractive and affordable benefit, it does have some limitations.

A few examples,

Limited benefit amounts. If you need more coverage than the group contract allows, you may need to seek additional coverage elsewhere.

Fewer optional riders. Individual life insurance generally provides more options in the form of added protection through policy riders. Policy riders provide extra coverage for things like – accelerated benefits for terminal illness, long-term care benefits, waiver of premium for disability, future additional purchase benefits, etc.

Lack of portability. In general, group term insurance ends when you leave your employer. In today’s world where switching jobs is common, relying solely on group term life insurance as a long-term planning tool can be less than ideal.

Should you offer group term life insurance?

Many companies today are finding it challenging to offer attractive and affordable benefit packages for employees.

Especially difficult is group health insurance due to its regulatory instability, escalating costs, and diminishing options.

Group life insurance, by contrast, delivers a cornerstone employee benefit that is consistent, predictable, and affordable.

And, in the event of an unforeseen tragedy, the economic and personal support group life insurance can provide to the family and loved ones of an employee is hard to exceed.

To learn more about group term life insurance quotes and plan options in Cincinnati, Ohio – complete and submit the form below.

As a bonus, we’ll send you our FREE guide: 14 Ways to Improve Company Benefits and Save Money.

Your privacy is important to us. Your email is never shared. View our Privacy Policy.